child tax credit portal not working

The IRS is still dealing with a backlog of tax returns and it is possible a delay in processing your tax return has caused a delay in processing your eligibility for the child tax. IMPORTANT INFORMATION - for filers of the following tax types.

How To Check Supplier Gst Status Status Tax Credits Tax Payment

I cant even get into the portal it keeps saying unavailable and doesnt have my name just TAXPAYER and the little cloud crying.

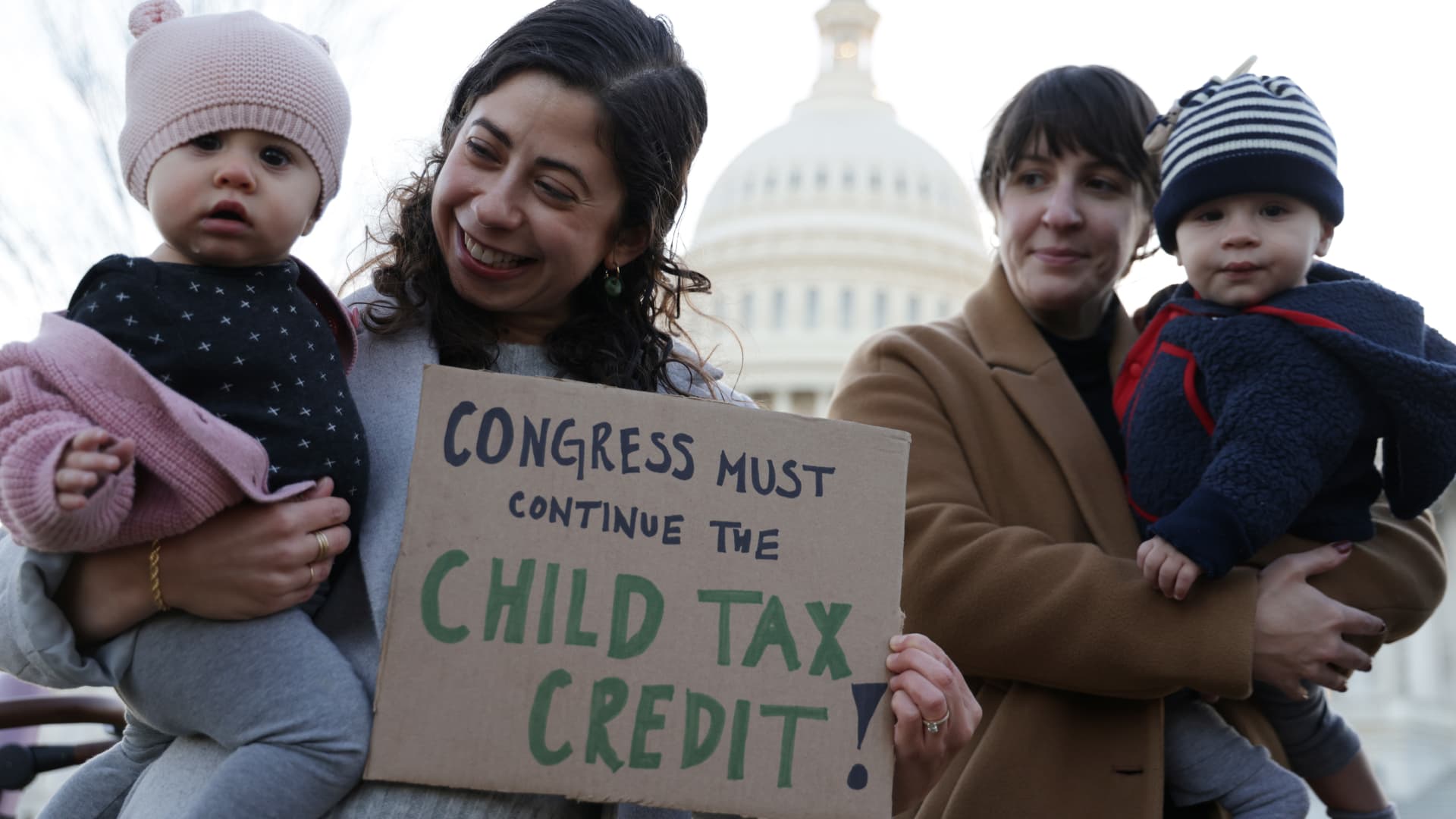

. Child Tax Credit Eligibility Assistant helps families determine whether they qualify for Child Tax Credit payments Update Portal helps families monitor and manage Child Tax. Updated on 72121. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility.

You can access the CTC Update Portal here. Department of Revenue Services. These payments up to 300 per month per child under age 6 and up to 250 per month per child age 6 through 17 will be paid in equal amounts and made no earlier.

Filemytaxes November 30 2021 Child Tax Credit Tax Credits. Claim Child Benefit Universal Credit How and when your benefits are paid Tax credits if you leave or move to the UK Help if you have a disabled. In order to sign in to any of the portals you will need to first verify your identity through IDme.

Visit ChildTaxCreditgov for details. Ok so my irs site showed checks being mailed as well but Ive always been dd. The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update.

If you who do not used the IRS portal to claim your advance Child Tax Credit benefits you can claim the credit when you prepare and e-File your 2021 tax return in 2022. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP which allowed you to update information with the IRS.

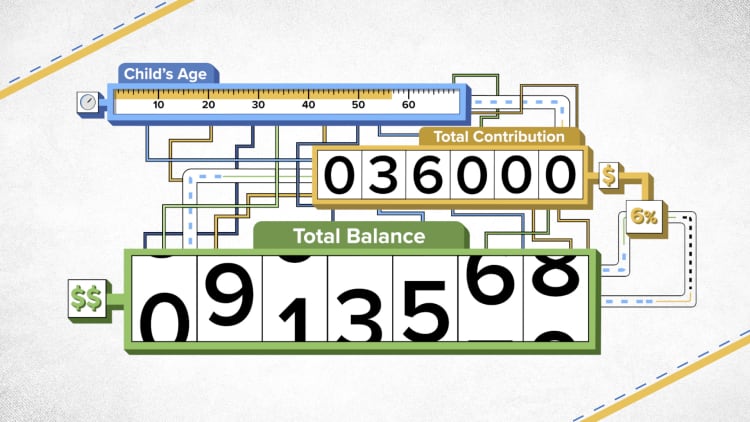

Connecticut State Department of Revenue Services. Millions of Americans dont care when the tax season begins or ends because they dont have to file. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased.

Have been a US. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021.

Half of the money will come as six monthly payments and half as a 2021 tax credit. Today it updated and shows it being sent to my bank under processed payment with bank. The Child Tax Credit Update Portal is no longer available.

The IRS will pay 3600 per child to parents of young children up to age five. That means if a five-year-old turns six in on or before December 31 2021 the parents will receive a total Child Tax Credit of 3000 for the year not 3600. Once you reach the homepage you will scroll down and click on Manage Advance Payments.

These people can now. The portal is no longer available and. From here you can see if you are.

The IRS has partnered with the third-party company to verify identities before.

2021 Child Tax Credit Advanced Payment Option Tas

The Advance Child Tax Credit What Lies Ahead

Here Is Why You May Need To Repay Your Child Tax Credit Payments Forbes Advisor

Missing A Child Tax Credit Payment Here S How To Track It Cnet

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Invoice Registration Portal Process Benefits Mode Of Registering In E Invoicing Portal Government Portal Invoicing Registration

Did Your Advance Child Tax Credit Payment End Or Change Tas

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Definition Of E Way Bills And Its Work Learn Accounting Accounting Notes Accounting And Finance